Maximize Your Financial Savings With a Federal Lending Institution

Checking out the globe of Federal Credit scores Unions for maximizing your cost savings can be a strategic economic action worth considering. Let's dive into the subtleties of optimizing your cost savings possibility with the distinct offerings of a Federal Credit Rating Union and how it can lead the means for a much more protected monetary future.

Benefits of Federal Credit Rating Unions

Federal Debt Unions are guaranteed by the National Credit Union Management (NCUA), offering a comparable level of security for deposits as the Federal Down Payment Insurance Company (FDIC) does for banks. Generally, the advantages of Federal Debt Unions make them a compelling option for individuals looking to maximize their savings while obtaining tailored service and support.

Subscription Eligibility Criteria

Subscription qualification requirements for Federal Credit score Unions are established to manage the qualifications people need to meet to come to be members. In addition, some Federal Credit Unions may need people to belong to a particular career or sector to be qualified for membership. Comprehending and satisfying these standards is crucial for people looking to sign up with a Federal Credit report Union and take benefit of the monetary benefits they use.

Interest-bearing Accounts Options Available

After determining your eligibility for membership at a Federal Debt Union, it is important to check out the numerous savings account alternatives readily available to optimize your economic benefits. Federal Cooperative credit union normally provide a series of interest-bearing account tailored to fulfill the varied requirements of their participants. One usual choice is a Routine Interest-bearing Accounts, which offers as a foundational make up participants to transfer their funds and make competitive rewards. These accounts frequently have reduced minimum balance requirements and supply very easy accessibility to funds when required (Cheyenne Credit Unions).

One more prominent option is a High-Yield Cost Savings Account, which offers a greater passion rate compared to regular interest-bearing accounts. This kind of account is optimal for members wanting to make extra on their financial savings while still preserving flexibility in accessing their funds. Additionally, some Federal Lending institution supply specialized savings accounts for particular financial savings goals such as education, emergencies, or retirement.

Tips for Conserving Much More With a Lending Institution

Looking to increase your savings possible with a Federal Cooperative Credit Union? Right here are some ideas to aid you conserve a lot more efficiently with a cooperative credit union:

- Benefit From Greater Rate Of Interest: Federal Debt Unions generally provide greater rate of interest on interest-bearing accounts compared to standard financial institutions. By depositing your funds in a cooperative credit union interest-bearing account, you can earn more rate of interest gradually, helping your financial savings expand faster.

- Explore Different Financial Savings Products: Credit rating unions supply a variety of savings items such as certifications of down payment (CDs), cash market accounts, and individual retired life accounts (IRAs) Each item has its very own benefits and attributes, so it's necessary to explore all alternatives to discover the ideal suitable for your cost savings objectives.

- Set Up Automatic Transfers: Arrange computerized transfers from your checking account to your cooperative credit union financial savings account. By doing this, you can constantly contribute to your cost savings without needing to consider it consistently.

Contrasting Lending Institution Vs. Typical Bank

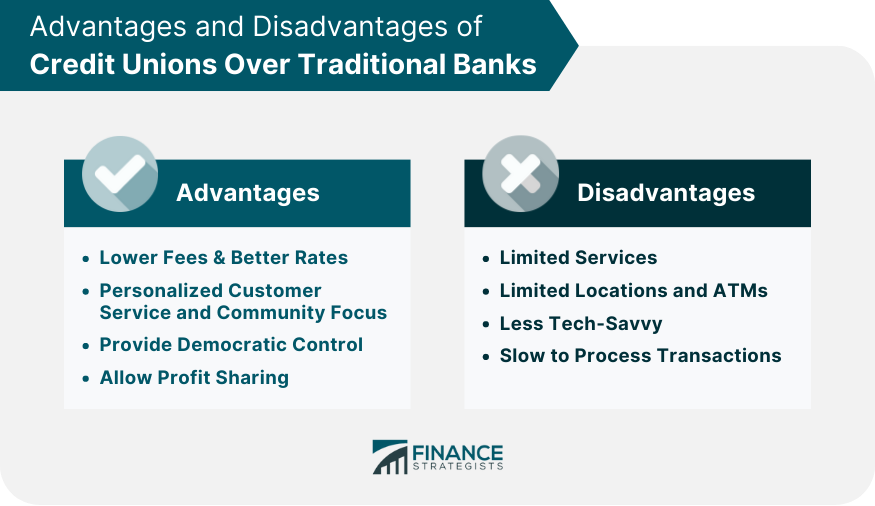

When reviewing banks, it is necessary to consider the distinctions in between cooperative credit union and traditional banks. Cooperative credit union are not-for-profit companies had by their participants, while traditional banks are for-profit entities had by shareholders. This fundamental distinction typically converts into better rate of interest on savings accounts, reduced funding rates, and less fees at credit history unions contrasted to financial institutions.

Credit report unions normally use an extra personalized strategy to banking, with a concentrate on neighborhood participation and member fulfillment. check out this site In contrast, conventional banks might have a more extensive variety of services and areas, however they can occasionally be regarded as less customer-centric because of their profit-oriented nature.

Another trick difference remains in the decision-making procedure. Cooperative credit union are regulated by a volunteer board of supervisors chosen by members, making sure that decisions are made with the most effective interests of the participants in mind (Cheyenne Federal Credit Union). Typical financial institutions, on the various other hand, find more operate under the direction of paid shareholders and execs, which can often cause choices that focus on revenues over consumer advantages

Eventually, the choice in between a lending institution and a typical bank relies on specific preferences, economic objectives, and banking demands.

Verdict

Finally, taking full advantage of savings with a Federal Credit score Union provides countless benefits such as greater rate of interest, reduced car loan rates, reduced charges, and outstanding customer care. By capitalizing on different interest-bearing account alternatives and checking out various savings items, individuals can tailor their savings technique to satisfy their economic goals effectively. Selecting a Federal Cooperative Credit Union over a traditional financial institution can bring about greater cost savings and monetary success over time.

Federal Credit scores Unions are guaranteed by the National Credit Union Administration (NCUA), giving a comparable degree of protection for down payments as the Federal Deposit Insurance Corporation (FDIC) does for banks. Wyoming Federal Credit best site Union.After establishing your eligibility for membership at a Federal Credit Scores Union, it is vital to explore the numerous cost savings account alternatives readily available to optimize your economic advantages. Furthermore, some Federal Debt Unions give specialized financial savings accounts for certain financial savings goals such as education, emergencies, or retirement

By depositing your funds in a credit report union financial savings account, you can make even more passion over time, helping your savings grow much faster.

Explore Different Savings Products: Credit rating unions supply a selection of cost savings items such as certifications of down payment (CDs), money market accounts, and individual retired life accounts (IRAs)